Current state of the stock market: This month has seen a particularly significant divergence in institutional behavior, with Domestic Institutional Investors (DIIs) avidly buying stocks while Foreign Institutional Investors (FIIs) have been selling them nonstop.

What happens after FIIs withdraw Rs 24,975 crore from D-Street in May?

FII & DII Data

Current stock market: In May, shares worth a total of Rs 17,082 crore were aggressively sold by Foreign Portfolio Investors (FPIs) on the Indian stock market. Foreign Institutional Investors (FIIs) are dumping a substantially bigger amount of Rs 24,975 crores in the cash market, indicating that the selling pressure in the market is still present.

This month has seen a particularly significant divergence in institutional behavior, with Domestic Institutional Investors (DIIs) avidly buying stocks while Foreign Institutional Investors (FIIs) have been selling them nonstop.

DIIs have bought stocks, while FIIs have sold stocks totaling Rs 24,975 crores. totaling Rs 19,410 crores during the course of the month.

Experts and analysts in the market claim that the selling by FIIs is motivated not only by election worries but also by India’s poor performance in comparison to other markets.

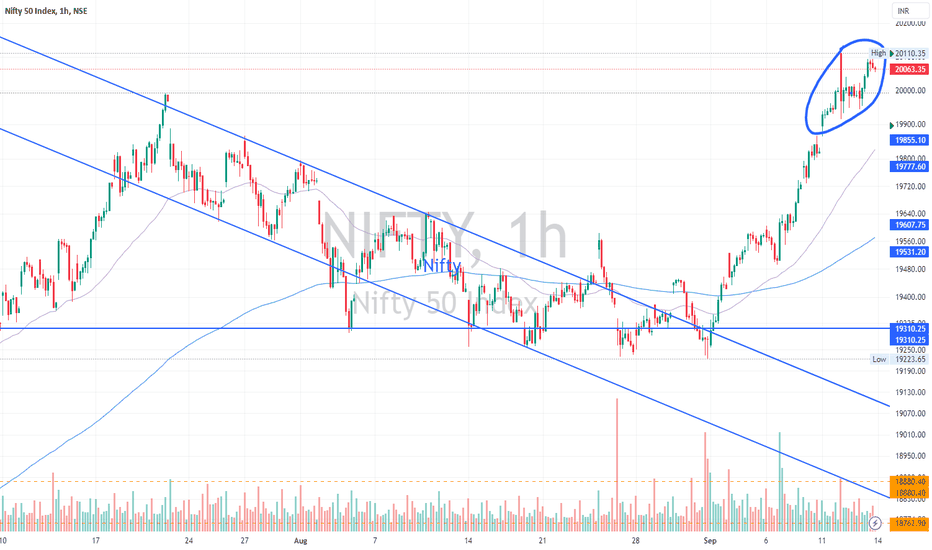

Tomorrow market direction:

According to Dr. VK Vijaykumar, Chief Investment Strategist at Geojit Financial Services, “FIIs are selling because India is underperforming while China and Hong Kong markets are outperforming, not because they are worried about the elections.”

The Shanghai Composite and Hang Seng indices have surged by 3.96 percent and 10.93 percent, respectively, over the past month, while the Nifty has dropped by 2.06 percent. China and Hong Kong markets have also seen impressive growth.

Due to the disparity in Asian market performance, FPI investment has strategically shifted to favor selling in India.

This is seen as somewhat pricey, and purchasing in China, especially via Hong Kong. Interestingly, India’s PE ratio is more than twice as high as Hong Kong’s.

It is expected that the FPI-adopted ‘Sell India, Buy China’ trend will continue to put downward pressure on Indian markets.

The experts note that if it becomes clear how the election will end out, this situation may undergo a dramatic change.

In the event that the election results meet market expectations, the market may rise quickly due to active buying by DIIs, retail investors, and HNIs, which would offset the FIIs’ current selling pressure.

What does the market hold in store?

According to Vinod Nair, Head of Research at Geojit Financial Services, the domestic market has been declining all week. originates from worries about the elections due to a reduced voter turnout and the premium valuation of the domestic market.

Due to uncertainty arising from the election, he anticipates that the current trend in the domestic markets will continue in the near future.

Investor attention will be focused on the release of the US and Indian CPI data, the GDP releases from Europe and Japan, and the FED chair speech during the data-hectic upcoming week. Furthermore, market mood will be influenced by the upcoming Q4 numbers, according to Nair.

According to Master Capital Services Ltd.’s Senior Vice President Arvinder Singh Nanda, the Nifty index has been fluctuating over the last several months between 21,750 and 22,800. On Thursday, there was a clear break below the immediate support of 22,300. It is expected that the Nifty will continue to decline in the near future. Based on past trends, there’s a chance that we may see a small upward correction from this important support level in the next trading sessions. The level of immediate resistance is fixed at 22,250.

Account opning link:

- Groww Account- https://app.groww.in/v3cO/kyrp1zph

- Kotak neo Account https://kotaksecurities.ref-r.com/c/i/32531/109103906

My name is Nitesh kumar and i am a Engineer but i have passionate in blogging, so these website updates day to day publish in stocks news and ipo’s and business related news update.

“Stock24News.com is your premier source for real-time financial updates and market insights. Stay informed with our expert analysis and comprehensive coverage of global stock trends.”

Thanks for your visiting in stock24news.com